Want to trade like the big boys? This homegrown app could help you

As featured on Channel NewsAsia

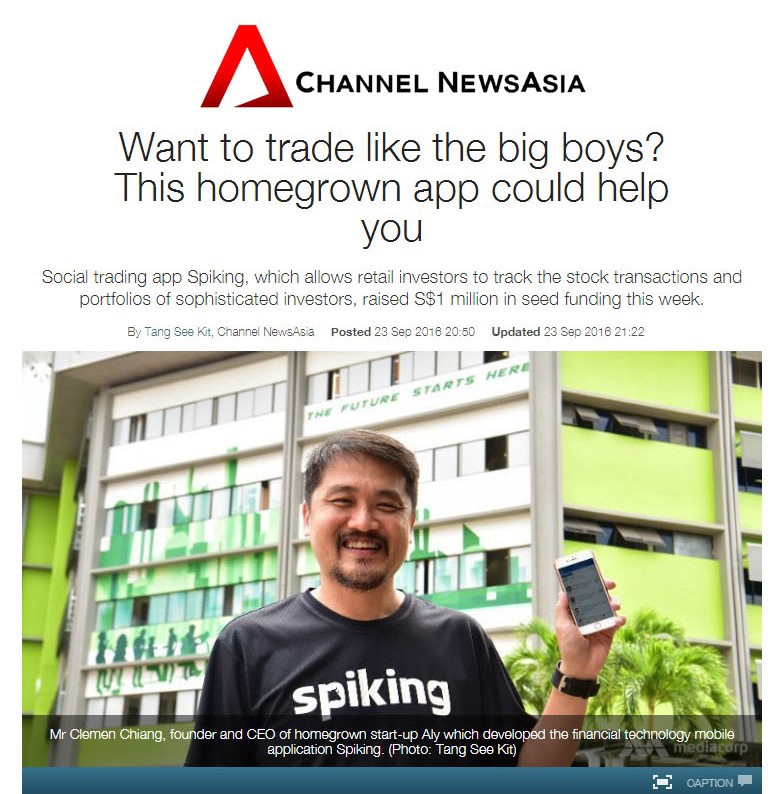

SINGAPORE: Just like any other avid investor, Mr Clemen Chiang has always been on the lookout for a winning strategy to beat the stock market.

A keen investor in US equities since the early 2000s, the Singaporean took interest in analysing the investment styles of American billionaires such as Warren Buffett after noticing that the legendary investor had steered clear of US technology stocks, which were the darlings of the market back then.

“I was looking at many hot technology stocks … for example, when Google (debuted) at US$100 on the Nasdaq in 2004, I invested in it,” said Mr Chiang, founder and CEO of homegrown financial technology (FinTech) start-up Aly. “But after some time, I noticed that many of these tech stocks were just too volatile … and Warren Buffett never invested in them, apart from IBM.”

Mr Chiang believed that by knowing the trades of these “big boys”, who have abundant resources to conduct due diligence and access to exclusive information, could help the common man on the street understand the sudden spikes in stock prices and make better investment decisions.

“After 15 years of investing, I’ve come to believe in the thesis of standing on the shoulders of giants such as Warren Buffett … After all, (he) has consistently outperformed the S&P 500 and I’m just not as smart as him,” the entrepreneur, who is in his early forties, told Channel NewsAsia.

“While investors like him won’t reveal their secrets, they have to reveal whatever they invest to the public and I realise that is the path for me to identify which giant I should (follow),” he added.

And that is why Mr Chiang came up with the app Spiking that helps him to do just that. However, on the back of advice from local accelerator Startupbootcamp FinTech, the entrepreneur decided to shift his focus from Wall Street to the local stock market.

Since its official launch in early April, the homegrown app has worked on enlarging its database and now provides information of 11,000 company directors and substantial shareholders in Singapore such as Banyan Tree founder Ho Kwon Ping, tycoons Oei Hong Leong and Peter Lim, as well as DBS Group chief executive Piyush Gupta.

Via Spiking, users can choose to follow these sophisticated investors and track updated disclosures of transactions and stock holdings. This information is obtained by machine-reading algorithms that scan through publicly-available stock exchange filings and verify them against various sources such as Bloomberg to check for anomalies, explained Mr Chiang.

While targeted at retail investors, the founder noted that Spiking has received positive responses from the senior executives of public companies as well as remisiers.

“Some remisiers told me they can now tell their clients that there’s information about these big shots buying and so what are they waiting for. It’s like a sales kit for them. Previously they relied on analyst recommendations which can sometimes be difficult for retail investors to understand.”

The local bourse operator also extended a helping hand, by expressing its willingness to provide the app with more data to work with. “That was a validation to our work,” Mr Chiang said.

“I LEARNT AND MOVED ON TO BE A BETTER MAN”

The successful conclusion of a S$1 million seed-funding round earlier this week was also a form of validation for the founder himself, who was in 2008 embroiled in a well-publicised expose by The Straits Times for touting qualifications from an unaccredited university.

After the expose, participants who attended Mr Chiang’s seminars on options trading sued him for refunds.

“I learnt a lot from that and I moved on to be a better man,” the entrepreneur told Channel NewsAsia. “It was a test of whether you can still stand up after a fall. I picked myself up … and I moved on to do other things.”

That included the starting up of female shopping portal CozyCot with his wife, and organising the Singapore edition of the Diner En Blanc pop-up picnic from 2012 to 2014.

When asked whether he was ever worried about investors turning him down due to his past, Mr Chiang answered: “The good thing is that when investors look at a start-up or entrepreneur, they have a completely different perspective from a retail investor. They look at what drives the company and the founder, and whether he can stand the test of failure. I think I’m a standing example of that.

“Investors from the capital markets know about my past and I share with them very openly. In the end, they said, ‘We still want to invest in you and we believe in how you’re going to take the company forward’,” he added, with a smile.

NEW FEATURES AND MOVING BEYOND SGX

Now, flushed with fresh funding from prominent capital market investors such as Sakae Holdings chairman Douglas Foo, the start-up is gearing up for a packed schedule ahead. Some of the plans include the addition of an online trading platform for users to place their trades via the app.

But before that, new features such as a forum page which will aggregate recent news headlines, announcements and market activity, as well as an expansion of data coverage to 10 stock exchanges will be rolled out in early December.

Apart from the SGX, Spiking is looking to ramp up its services to include data from the stock exchanges in Australia, Hong Kong, Malaysia, Thailand and the Philippines, as well as the two stock exchanges in Vietnam and India, respectively.

Among the overseas markets, Mr Chiang singled out India as the biggest challenge given the sheer number of companies listed on the Bombay Stock Exchange and National Stock Exchange.

“There are about 10,000 companies listed in India and for each company, we will have to (identify) the blue whales who are people putting money on the table, the board of directors who make strategic decisions and then the management group,” he explained.

But Mr Chiang remains upbeat about the expansion plans and has his ultimate goal set on Wall Street.

“We are still a start-up and if we go to the US now, we are just killing ourselves. So let’s start off with 10 exchanges in Asia-Pacific and if that works out, we’ll go for another round of funding and go after the US market,” he told Channel NewsAsia.

- CNA/sk