Bitcoin, will it spike?

Part 3 → A Series on the Future of Cryptocurrency

Part 3 → A Series on the Future of Cryptocurrency

Since 2010, Bitcoin had spiked a total of seven times. Spiking up ranging from 5X to 500X; whereas spiking down above 90% for two out of the three bear runs. Is this trend sufficient knowledge for us to predict the next spike?

Let’s take a deep dive to unravel the prophesy.

#1 Spike 🚀 500X → $0.06 Oct 2010 to $30 Jun 2011

All it takes is just 8 months to deliver an astounding 500 times return. Put it plainly, a $2,000 investment will turn you into a millionaire. But, this part of the history is not going to repeat itself unless we understand how the remaining spikes evolved. Remember, this was 8 years ago…

#2 Spike 🔥 -90% → $30 Jun 2011 to $2 Nov 2011

Massive crash at more than 90% from its high of $30. But it didn’t break the support at $2. In retrospect, the initial pool of traders at 6 cent still enjoy a remarkable 30 times return. Chart-wise, you are looking at a 45-degree down trending line before the bounce off at $2.

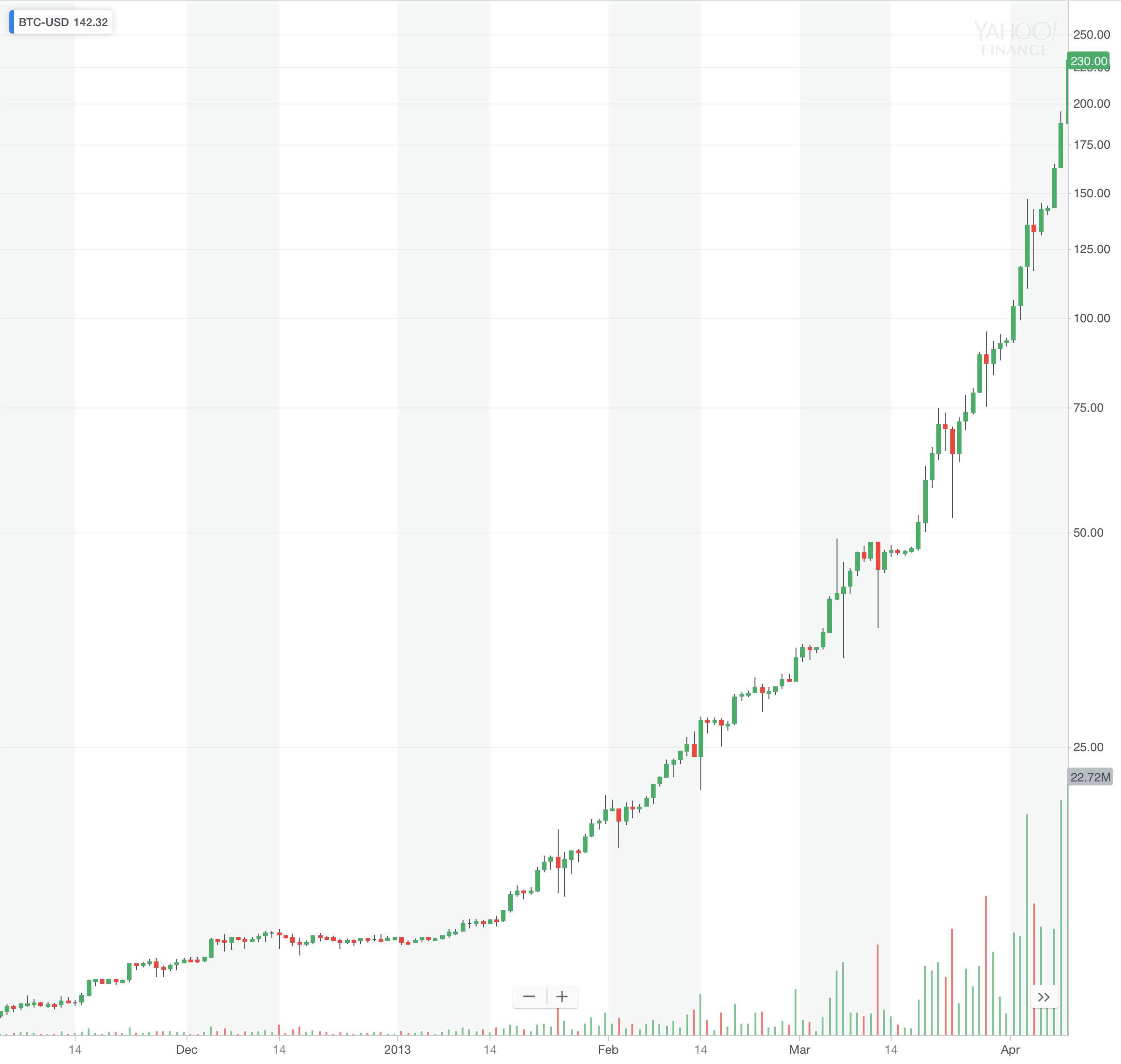

#3 Spike 🚀 115X → $2 Nov 2011 to $230 Apr 2013

Compared to #1 Spike, this second bull run took twice the amount of time (approximately 17 months versus 8 months) to hit the peak and delivered 115 times return. Now, the chart shows a side-way moving line with a subsequent “hockey stick” 45-degree up trending line.

#4 Spike 🚀 5X → $230 Apr 2013 to $1,240 Nov 2013

Compared to the previous #3 Spike, both are looking almost identical! Side-way moving line leading to a “hockey stick” climb. But, the duration is shorter at 7 months compared to the previous 17 months wait. Here’s the interesting part. What if we combined #3 Spike and #4 Spike together? It’s a two-year holding period that delivered $2 to $1,240. A 620 times return; which is more than the 500X in #1 Spike.

#5 Spike 🔥 -90% → $1,240 Nov 2013 to $100 Feb 2014

This is déjà vu to #2 Spike! More than 90% crash with a shorter time period of 3 months compared to the previous 5 months. This serves as a reminder to all of us that crash literally means crash. It is fast and furious.

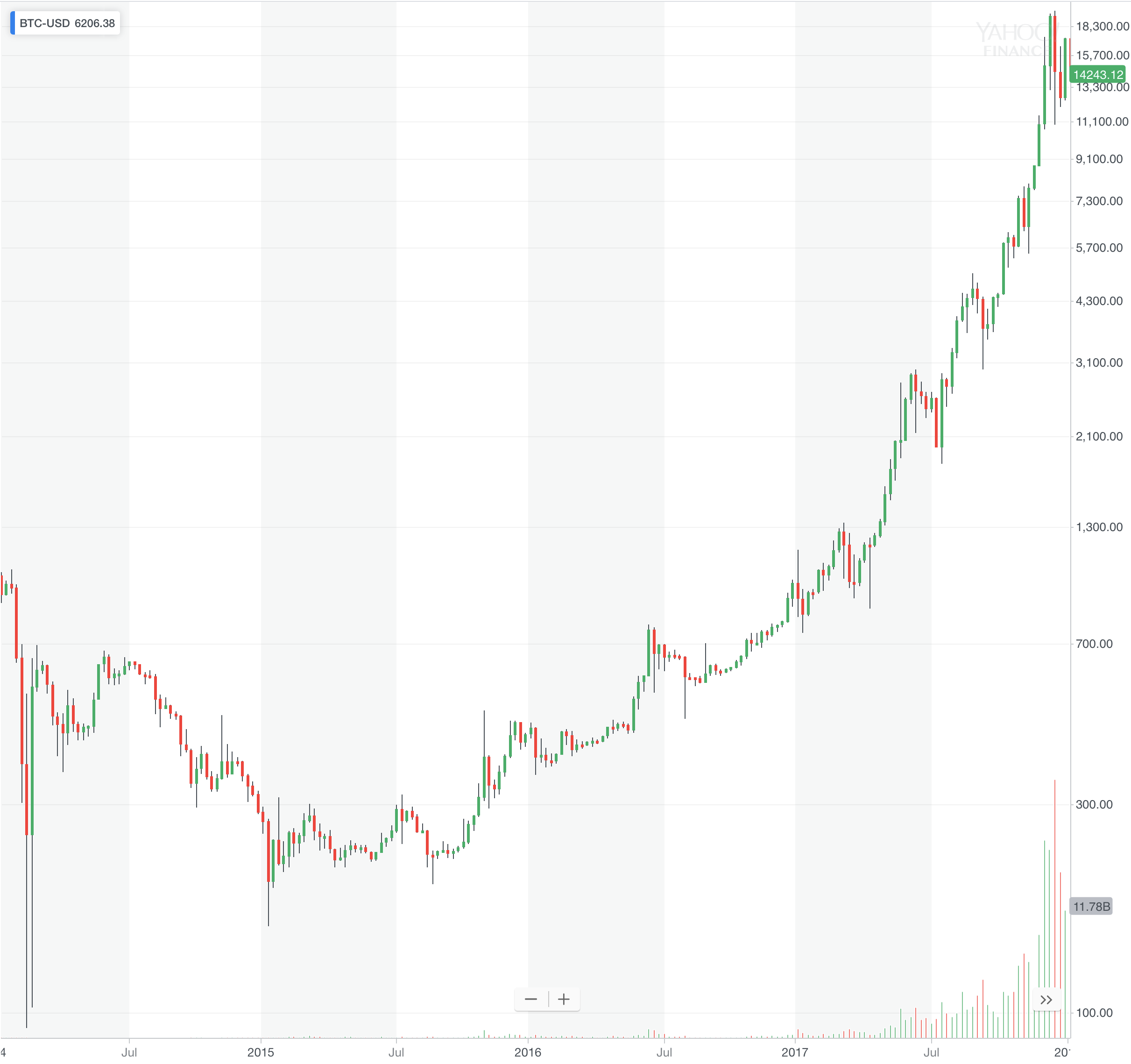

#6 Spike 🚀 190X → $100 Feb 2014 to $19,000 Dec 2017

Final reminder of the *side-way moving line leading to a “hockey stick” climb*. Longest wait over 46 months that delivered 190 times return. In comparison against #3 Spike & #4 Spike versus #1 Spike, this 190X is the lowest return (620X versus 500X respectively) with the longest wait 46 months (24 months versus 8 months respectively).

P.S. 500X → 620X → 190X → ???X

P.P.S. 8 months → 24 months → 46 months → ?? months

Perhaps, this sets the stage for the next bull run? We will have to expect a much lower return with an even longer waiting period 😅

#7 Spike 🔥 -68% → $19,000 Dec 2017 to $6,000 Aug 2018

If we take the two previous precedents of crashes (#2 Spike and #5 Spike), we should expect a drop of 90% from the high of $19,000 to hit rock bottom at $1,900. But hey! Previous two crashes took between 3 to 5 months to reach support levels. This time round, we are down for more than 8 months and yet we still do not see the light at the end of the tunnel. Looking at the chart, it is not “clean” like the previous two down-trending 45–degree lines. Keyword to describe is choppiness.

Must we wait for the price of Bitcoin to trade at $1,900 before the dust settles down?

In the final analysis, I believe that the end game depends very much on “old money”. Will the very rich consider Bitcoin or cryptocurrencies as part of their portfolios? On this note, the team at Spiking is watching the portfolios of billionaires, millionaires, and blue whales very closely. This, I believe, is the key to unlocking the fullest potential of Bitcoin pricing.

References:

1. https://finance.yahoo.com/news/amid-2018-crypto-crash-3-kinds-believers-come-focus-202424977.html

2. https://coingape.com/bitcoin-market-making-detailed-study-reveals

3. https://www.cnbc.com/2018/09/03/china-clamps-down-on-cryptocurrency-speculation.html

4. https://www.bizjournals.com/bizjournals/how-to/growth-strategies/2017/03/how-old-money-and-new-money-habits-differ.html